General information

Please be sure you’re familiar with the LF Expense Policy before booking any travel.

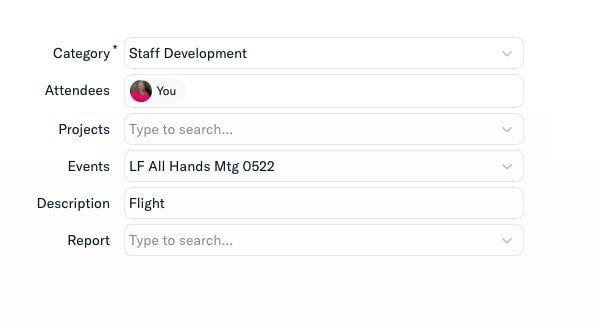

All expenses for the LF All-Hands Meeting should be charged to:

- Category: Staff Development

- Projects: (Insert if you have one)

- Events: LF All Hands Mtg 0522

Things to expense

- Hotel: Nights covered by the Linux Foundation will be charged to the master bill. You will be required to put a credit card down upon check-in for any incidentals, along with any additional nights you’ve requested outside of the nights covered by the LF.

- Meals: Breakfast, lunch, and dinner will be provided for all attendees Monday – Thursday (attendees on own for breakfast Monday and dinner Thursday night). Any extracurricular activities, food, and drinks, during the week, cannot be expensed. Per diem on travel days is $60 per person domestically and $100 per person internationally.

- Transportation: Transportation to/from the airport can be expensed within Expensify, with an accompanying receipt.

All expenses should be submitted through Expensify unless otherwise noted by your manager.

Policies + procedures

- Expenses in excess of 90 days old will not be reimbursed.

- Expenses will be reimbursed on the first available date after approval.

- Travel expenses must be estimated and verbally approved by the head of the employee’s department prior to the purchase of tickets or the date of travel.

- Detailed supporting documents must be submitted for all expenses in excess of $25.00 USD unless submitting a Guaranteed Receipt (see Expensify Setup and Training tutorial).

- In most cases, this is evidenced by a receipt from the payee describing the product or service purchased.

- Airfare can be supported by a copy of an electronic ticket as long as it stipulates the itinerary for travel AND the ticket cost detail.

- E-mailed receptions for online purchases are acceptable as long as they specify items purchased and the method of payment used.

- By using the Guaranteed Receipt, you are not required to provide a paper receipt for credit card expenses under $25 expect lodging

- Mileage must be supported by Google map data and will be reimbursed at the prevailing “Standard Mileage Rate” established by the IRS.

Procedure

- Preparer should:

- Audit all expense items. Make sure there are supporting receipts.

- Provide details in Comment fields (i.e., RT Airfare from SFO-LAX March 1-5 for Meeting with Samsung).

- Make sure that the expenses are within limits and are approved as required by company policy.

- Submit expense reports through your Expensify account to your manager for final approval.

- Finance/Accounting Dept will receive final approved report from employee’s manager, and Expensify will pay out the expense.

- Methods of Payment (set up in Expensify):

- Direct Deposit (domestic only): employee will be reimbursed through direct deposit to employee’s personal bank account.

- For employees outside the United States, reimbursement will be via wire transfer to employee’s personal bank account.

- You can also link your PayPal account for reimbursement.